Who is the real Mr Cash of Bulgarian politics?

Tracking imports of diesel fuel from Russia to Bulgaria

Despite the total ban, Russian fuel imports into the EU have never stopped and Bulgaria has had its fair share.

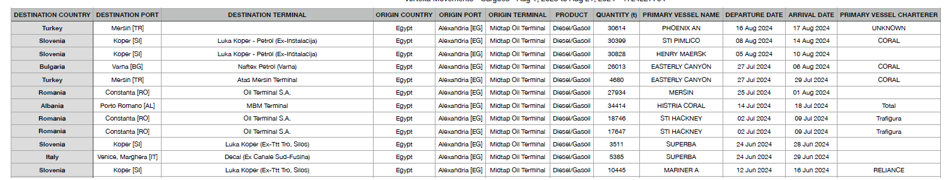

The main player in the beginning was Turkey with its imports of mostly Russian diesel through the ports of Mersin and Dortyol, where the product was re-labelled with new certificates of origin issued by the local chamber of commerce and shipped on to the EU.

There are no saints in this certificate swap business, and this article is an attempt to lift the lid on the secrecy behind the recent switch from Mersin in Turkey to Alexandria in Egypt, where Russian diesel cargoes are also re-labelled as an Egyptian product.

The entire sanctions-busting system used by Russian companies to sell their crude or refined oil products in the European Union is constantly being upgraded to keep up with the latest sanctions technology. In a sense, there is a race between those who design sanctions and those who circumvent them. Russian oil companies, backed by Russian diplomats and intelligence services, are active in various countries that resell Russian refined products, such as the UAE, Tunisia, Libya and Turkey, to which, as mentioned above, Egypt has been added.

Revenues from the sale of Russian crude oil remain substantially high, with the latest IEA estimates for July at around $17 billion, and this figure shows no sign of abating. This trend continues despite sanctions targeting the value chain of refined products via the dark fleet scheme after loading at oil terminals in Russia, including insurers (Ingosstrakh and SOGAS), charterers and traders.

Let’s look at a recent shadow trade scheme. In this scheme, Russian diesel loaded in Novorossiysk, after a voyage to Egypt, ends up in the port of Varna, benefiting prominent Bulgarian fuel traders and a notable oil oligarch linked to the even more influential political oligarch Delyan Peevski. Bulgaria is just one of the many EU member states that import re-labelled Russian diesel. Consider just one recent snapshot in this ongoing scheme.

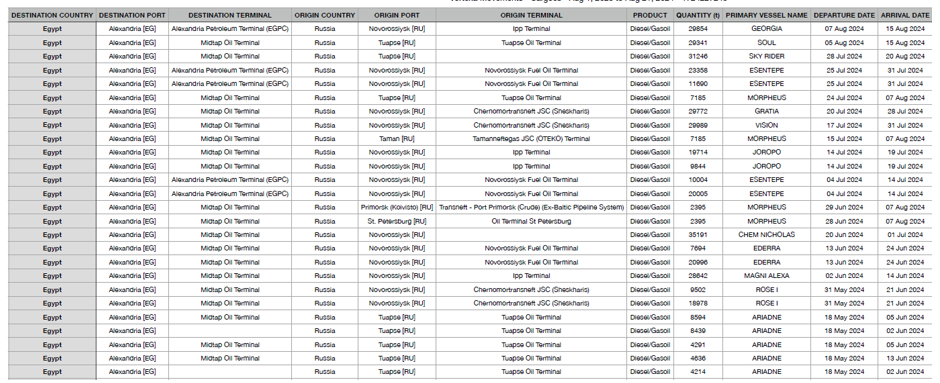

According to the real-time energy cargo tracking company Vortexa’ data during the last 12 months more than 50 tankers with about 1.4 mln MT Russian diesel have been discharged at the oil terminals in Egypt. While Egypt has several refineries, their capacity and technology have been somewhat limited, resulting in an inability to fully meet the domestic demand for refined products. which explains why in the last decade the country has always been a net fuel importer. Suddenly, in the last year or so, Egypt has become a major exporter of refined oil products, with more than 24 tankers carrying some 660,000 MT of diesel leaving the country for various destinations in the Mediterranean, mainly to EU ports.

The Russian refined oil product re-labelling scheme is based on the premise that Egypt has refineries that can formally produce the same commodity from the crude oil they process. The problem with this narrative is that the refined product never reaches the local market and in most cases is simply discharged into the shore storage tanks at the Alexandria oil terminal and then re-loaded with the altered certificates of origin.

In our specific case with the diesel cargo delivered to the Varna oil terminal, the seller is the BAHE Energy – full name BAHE ENERJİ SANAYİ VE DIŞ TİCARET LİMİ, registered in Istanbul. For the diesel delivery to Varna, BAHE Enerji used the Marshall Islands-flagged tanker Easterly Canyon, chartered by Coral Energy, part of Rosneft’s proxy network, to transport Russian diesel from the tank at the Alexandria oil terminal to Varna on the premise that the diesel was produced at the MIDOR refinery – with a certificate of origin.

If you like this article, please support us with a donation to PayPal and to the direct account of the association Alternatives and Analyses IBAN BG58UBBS80021090022940. This will ensure that there will be further analyses

On the way, the ship stopped at the Turkish port of Mersin, which frequently appears in the records of tankers that have delivered fuel to Bulgaria. It unloaded 4,500 MT in Turkey before proceeding to Varna with the remaining 25,500 tons. The Easterly Canyon with Russian diesel with Egyptian CoO, docked at the Varna oil terminal and stayed there for four days, from 6 to 9 August, with diesel buyers two prominent players in the Bulgarian fuel market among which the close to the Magnitsky sanctioned Peevsky Insa Oil.

According to Alternatives & Analyses sources, the relatively long stay – three days – is explained by the specific purpose of paying for the sanctioned product in a way that the authorities cannot trace. First, INSA Oil joined forces with another Bulgaria fuel trader to share the purchase of the Russian diesel because the Bulgarian banks limited each company’s bank credit. Then, advance payment for spot sales is a sine qua non, and it took time for both seller and buyer to seal their interest in the deal – delivery versus payment. Finally, it is important to ensure that border and customs officials are not too scrupulous in verifying the origin of the product. The typical response to this and other inquiries by customs officials is that we are not obliged to look beyond the authenticity of the certificate presented. However, the Bulgarian General Directorate of Customs has its intelligence experts and much better access to ship tracking data and sources to find out what our open source team has found. Nominally, the customs official does not need to look beyond the certificate of origin, and the Egyptian one seems authentic.

An ongoing international investigation could dig deeper and identify the counterfeit characteristics typical of Russian diesel fuel and the product received in Varna or Bourgas. Every type of diesel bears the mark of the refinery, and Russian refineries and crude oil are no exception.

The shadow chain for this cargo of Russian diesel re-labelling operation ends in Varna, where Bulgarian customs and border authorities usually stick to the formal documentation. The cargo’s customs papers from Varna are processed at the Insa Oil refinery, where the quality of the product is tested in the INSA laboratory, and the customs authority is happy to let the diesel be “processed” further. This line of control illustrates the extent of state capture – both the Ministry of the Interior (border police) and the Customs Agency are under the direct control of Mr Delyan Peevski. He orchestrated the arrest of the former head of customs in the Denkov government on a false pretext to ensure that senior customs officials in Varna, Bourgas and other border posts would look the other way when it came to importing Russian diesel or other ‘sensitive’ goods.

In addition, the major players in the fuel sector and the Bourgas refinery, and hence the state budget, are suffering from unfair competition from dumped Russian diesel prices. The negative fiscal and market effects are difficult to measure, not to mention the country’s tarnished reputation as a buyer of sanctioned Russian energy products, which adds to the Kremlin’s war chest. But the main driver, as with Russian gas, is the dumping price of diesel, sold at a steep discount – more than $100 a tonne for middlemen, mostly Russian, from the oil terminal in Russia to the pump, and billions in cash for Putin’s coffers.

For the record, INSA Oil has imported 300’000 MT of diesel this year alone. One can only speculate on the Russian diesel share in the Bulgarian market, but most cargoes have been received from Mersin and now Alexandria. Next in the relabeling scheme – Libyan ports.

The above provides a clear guide to who is the real Mr Cash in Bulgarian politics.

A & A investigation team